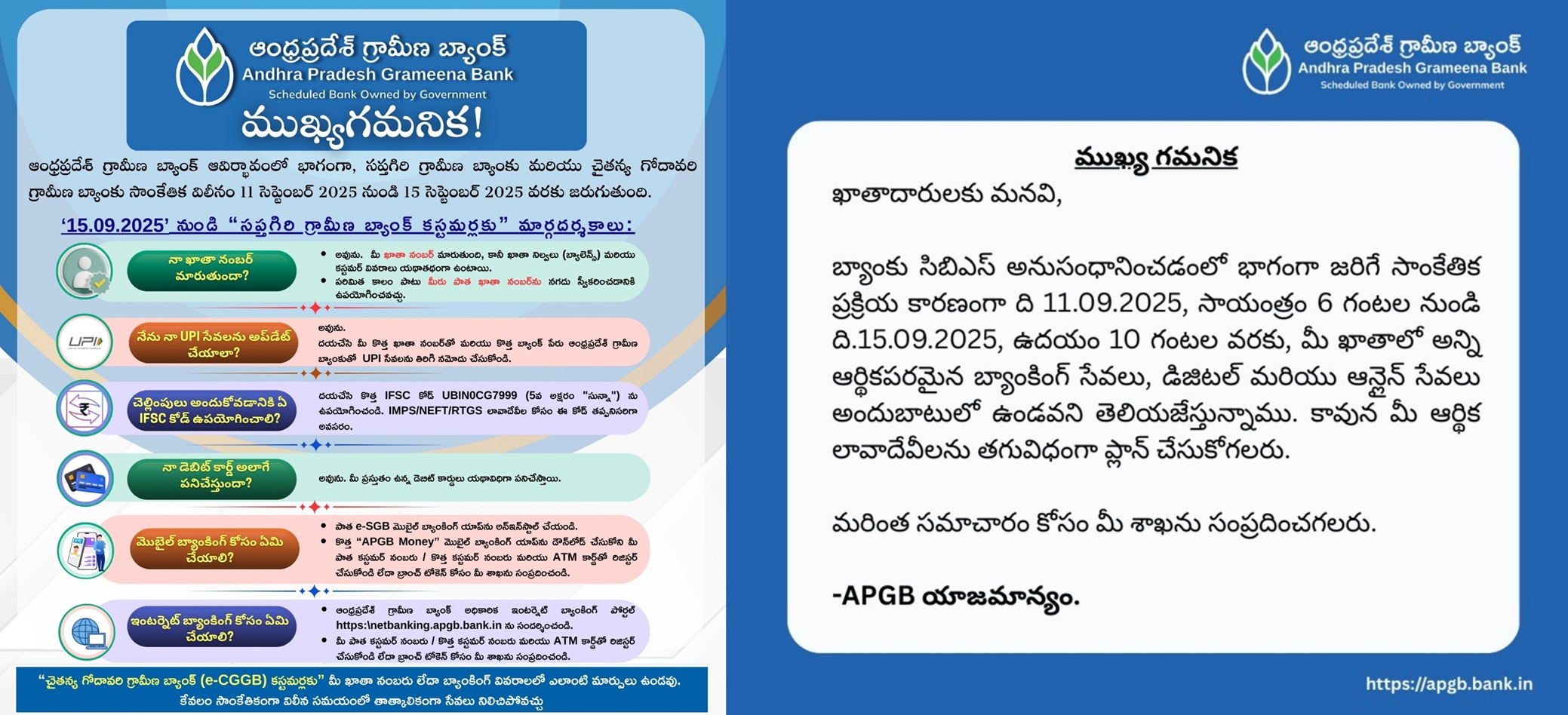

Important Message

What's New

Media Gallery

Inauguration of New Premises at Chemmanagiripeta by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Customers Interactive Meet held on the occasion of opening of new premises at Chemmanagiripeta

Inauguration of New Premises at OGU by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Lighting up diya on the occasion of opening of new premises at OGU by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Inauguration of New Premises at Kandukur by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Group Photo of General Manager & SGB Staff at Kandukur Branch, Saptagiri Grameena Bank

Inauguration of New Premises at Chowdasamudram by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Customers Interactive Meet held on the occasion of opening of new premises at Chowdasamudram

Inauguration of the Head Office Own Building marked by the placement of this commemorative stone, unveiled by Shri Shiv Bajrang Singh, Executive Director, Indian Bank

Ribbon Cutting Ceremony, graced by the august presence of Shri K.Sumit Kumar, IAS and Shri Shiv Bajrang Singh, Executive Director, Indian Bank

Saptagiri Grameena Bank Head Office Staff along with Indian Bank Officials on the occassion of the Inauguration of SGB Own Premises

Inauguration of New Branch at Vellore Road, Chittoor by Shri V.Chandrasekaran, General Manager(FI,RBD/RRB/SLBC), Indian Bank

Lighting of diya on the occasion of opening of new branch at Vellore Road, Chittoor

Customers Interactive Meet held on the occasion of opening of new branch at Vellore Road, Chittoor

Lighting up diya on the occasion of opening of new premises at Thottambedu by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Group Photo of General Manager & SGB Staff at SGB Thottambedu Branch, Saptagiri Grameena Bank

Inauguration of New Premises at Balliparru by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Inauguration of New Premises at Mahal by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Lighting of diya on the occasion of opening of new premises at Mahal

Inauguration of New Premises at Chembakuru by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Lighting of diya on the occasion of opening of new premises at Chembakuru by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Lighting of diya on the occasion of opening of new premises at Pachikapallam by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Group Photo of General Manager & SGB Staff at SGB Pachikapallam Branch, Saptagiri Grameena Bank

Inauguration of New Branch at Pachikapallam by Shri D.Prabaharan, General Manager, Saptagiri Grameena Bank

Inauguration of New Premises at Tiruvuru by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Lighting up diya on the occasion of opening of new premises at Tiruvuru by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Inauguration of New Branch at Battamdoddi by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Inauguration of New Branch at Rayalpeta by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Lighting up Diya on the occasion of opening of New Branch at Rayalpet by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank

Inauguration of New Premises of Damalcheruvu Branch by

Shri D Prabaharan, GM, Saptagiri Grameena Bank.

Lighting of diya by Shri D Prabaharan, GM, Saptagiri Grameena Bank on the occassion of inaugurating New Premises of Damalcheruvu Branch.

Inauguration of Pudipatla Branch by Shri K Venkata Ramana Reddy, IAS, Collector and District Magistrate, Tirupati.

Inauguration of Pudipatla Branch by Shri K Venkata Ramana Reddy, IAS, Collector and District Magistrate, Tirupati.

Lighting of diya by Shri A S N Prasad, Chairman, SGB on the occassion of inauguration of Pudipatla Branch

Felicitation of Shri K Venkata Ramana Reddy, IAS, Collector and District Magistrate, Tirupati during the inauguration of Pudipatla Branch

Opening of New Premises at Veeravalli by Shri A S N Prasad, Chairman, Saptagiri Grameena Bank.

Opening of New Branch at Guntupalli by Shri Mahesh Kumar Bajaj, Executive Director, Indian Bank.

Opening of New Branch at Guntupalli by Shri Mahesh Kumar Bajaj, Executive Director, Indian Bank.

Shri Mahesh Kumar Bajaj, Executive Director, Indian Bank and SGB Chairman Shri A S N Prasad on occasion of opening of Guntupalli Branch.

Lightning of Diya on the occasion of opening of new branch at Guntupalli

Opening of New Branch at Nagayalanka by SGB Chairman Shri A S N Prasad.